Coronavirus, the Economy and a Recovery: The Way Through, Part 2

March seems like a long time ago, even though it’s only been six months. Life in Corona Times. Back in March we had just started shutdown here in the United States, the economy ground to a halt with exception of a few essentials, the stock market plummeted. We found comfort in Netflix and a stockpile of toilet paper. Those who could started working from home (WFH). Kids who could moved to online learning. The world got quiet and we waited.

Spring came, birds sang, flowers bloomed. The stock market recovered. Curves were flattening in early hot spots. We figured out the best lighting for our Zoom/Teams/Google Meet meetings. We stocked up on masks. Congress moved rapidly to structure relief for individuals, businesses, and organizations large and small. We watched a hodge-podge of plans for restarting the economy spark and fizzle. We watched the death toll rise as the virus rolled out over the country.

Now, as we approach the end of Summer, where are we? Besides still stuck at home.

THE CASCADE OF CRISES CONTINUES

The public health crisis created an economic one, the economic crisis became a financial crisis, and we circled back around to the growing public health impact, which created an unemployment crisis. In May we recorded 20.5 million Americans out of work. By August, even with some restart of activity, more than 1 million new unemployment claims were filed early in the month. Delayed layoffs are mounting, as companies hoping to wait out the coronavirus run out of time, and others use the moment to prune workforces.

We thought by now we’d be through the First Wave of the coronavirus and preparing to take on the Fall’s Second Wave. But we never got past the first wave of the virus, we’re still in it. We’ve managed to circle back to the public health crisis by opening the economy too soon, and with economic relief tied to the arbitrary date in mid-summer, we are headed into a second wave of economic pain. We’ve learned a lot about coronavirus in six months, but it has been a long six months, and this has brought with it a new crisis: mental health. So now we’re dealing with TWO types of depression caused by the pandemic.

PANDEMIC DEPRESSION #1: MENTAL HEALTH

The coronavirus is exacting a toll on more than our physical health. With stay-at-home and physical distancing orders continuing, and greater economic pressure on households and businesses – despite Wall Street’s recovery through the Summer – we’ve added to the Crisis Cascade: We are full-on amid a mental health crisis, with individuals and families stressed out by the lockdown, the stress of personal finances, the stress of school openings, by the grief over losses – of friends and family affected by Covid-19 and of the lives we had before, and finally the stress of uncertainty about how the pandemic will end.

We are not at our best when under stress. The reptilian part of our brain takes over and fight-or-flight responses kick in. Expect to see “fight” kick in increasingly as we move forward: More unrest, more lashing out in public over mask-wearing, to more violent and deadly encounters. The Spring brought a spike in gun sales – 3 million more guns sold since March through mid-July than normal. Some of these sales were shifted from early days of the shutdown into later months, but the result is that more Americans are armed.

The spike in guns sales was not accompanied by a spike in background checks, and training in gun handling does not come with any gun purchase. Adding a gun to almost any confrontation is not likely to help matters, especially in the hands of untrained and inexperienced users.

The best advice here: Give others a wide berth for social distancing, and because we are stressed out.

PANDEMIC DEPRESSION #2: ECONOMIC

The downstream impact of this year’s depressed economic activity is the blunted purchasing power of households. One of the reasons the stock market seems to be unaffected by our public health crisis is the impact of money pumped into people’s hands through fiscal stimulus (government spending). Payments to individuals, loans to enterprise, and additional unemployment benefits “stimulate” the economy by moving taxpayer dollars from the government to consumers, and from their hands into the economy.

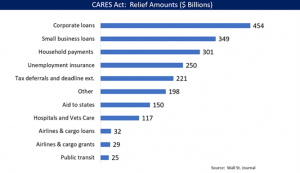

The CARES Act, passed in May, pumped $1.76 trillion into the economy. The chart to the right shows where it went.

The CARES Act, passed in May, pumped $1.76 trillion into the economy. The chart to the right shows where it went.

Part of it was a direct payment to you (up to $1,200 each), provided your income was below certain thresholds.

Extra unemployment benefits of $600/week were tied to a calendar date (July 31st). That end date was needed to put a price tag on the package, but it would have been a better strategy to tie the extra $600/week not to a fixed date but to the achievement of a clear metric for getting the virus under control, like reaching a low per capita percent of the population testing positive for coronavirus. That would have aligned those who don’t want to spend on economic relief with measures to defeat the virus’ spread.

THE MULTIPLIER EFFECT

Whether you are in favor of fiscal stimulus or not, its multiplier effect is well-established, though estimates vary widely: from the Public Works Administration following the Great Depression of the 1930’s to tax rebates used in response to the Financial Crisis in 2007-09. These efforts were geared towards those who were most likely to spend that money, multiplying the effect of the stimulus by helping not only the individual, but the businesses where they spent the money, thus propping up the economy and other workers in it.

Using greater fiscal stimulus to assist in the recovery from the Financial Crisis was a missed opportunity. We could have put money in people’s pockets by keeping them employed, especially those in the trades, to build and repair roads and bridges, for example. When the private sector was struggling, government spending would have lifted a hard-hit sector of the economy, while reaping the benefits of investing in our infrastructure.

THE CRISES TO COME: STATE AND LOCAL GOVERNMENTS, HOUSING

A big part of what is holding up the next relief package is about two trillion dollars. Senate Republicans have proposed the HEALS Act (at about $1 trillion) in response to the House Democrats’ HEROES Act ($3 trillion). The latter has about $1 trillion in aid to state and local government compared with no new aid to state and local governments in the GOP proposal.

Part of the safety net in times of economic insecurity, state and local governments will be slashing spending to meet balanced budget requirements in the face of dramatically reduced tax revenues. With social service charitable entities also operating with drastically reduced funding, there won’t be many places for people to go for help.

In May, a Columbia University economist Professor Brendan O’Flaherty projected a 20% increase in homelessness in California in 2020, and a possible 40% to 45% increase across the country, as we stay mired in waves of the coronavirus. Rent and mortgage relief have helped push this crisis down the road, but a new one is looming. Once we move from Summer to Fall and Winter, staying outside becomes impossible in many regions and social distancing a challenge indoors. Whether 2021 begins with more homeless Americans in modern-day Hoovervilles – Trumptowns or Bidenburghs – remains to be seen.

The alternative is to leave people to fend for themselves, and that is one way to turn a deep global recession into a worldwide depression. Economies aren’t abstract things, they are collections of real people. Downturns have a human toll as well as an economic one. Being out of work for a prolonged period damages a worker’s job opportunities and lifetime earnings, and also their health and spirit. Those on the bottom rungs of the economic ladder – those without college degrees and often people of color — are hit the hardest.

The cascade continues: Longtime unemployment and reduced demand depresses business investment, tightening the contraction and strangling our productivity well beyond the initial economic decline. It took 10 years after the Financial Crisis to recover the jobs lost in that downturn. In this one, some jobs will not be coming back. The more we can do now to get everyone through to the other side of the pandemic helps us all.

THE ALPHABET SOUP OF STOCK MARKET RECOVERY

So that’s where we are with regard to the economy: More than 11 million Americans are unemployed, 6.2 million workers have lost access to health insurance through their employer (adding to the more than 27 million Americans without health insurance pre-pandemic), and GDP is down over 32% compared to the first quarter of the year, the single largest quarterly contraction since we started tracking it. But the stock market is doing GREAT, the recent turmoil notwithstanding.

Meanwhile, Wall Street has mostly been arguing over what kind of recovery we’ll have:

V-shaped (quick drop and equally quick recovery)?

U-shaped (quick drop, languishing at the bottom, then rebound)?

W-shaped (sharp drop, sharp rebound, second drop with later recovery)?

Or Nike Swoosh-shaped (sharp drop, s-l-o-w climb back up)???

If you chart the stock market (using the S&P 500 Index here), it looked like a V-shaped recovery back in May; as of late it looks more like a Nike “Swoosh”.

THE K-SHAPED RECOVERY

Increasingly, the scuttlebutt is about a “K-shaped recovery”: if you were doing well before the pandemic, you’re probably ok — possibly even better now; if you were struggling, that struggle is getting even harder. Income and wealth inequality are not new, and the pandemic is breaking wide the chasm between the Haves – those with WFH jobs, health insurance, money in the bank, and the ability to avoid the virus – and everyone else: essential workers and those who work in fields in which one cannot work without violating public health guidance, and risking their own health.

The workers in the first group are the ones likely to have 401(k)s and other savings, accounts enjoying the stock market recovery. Economist Paul Krugman points out that over 50 percent of all stocks are owned by only 1 percent of Americans; those in the bottom half of the population economically own only 0.7 percent of the market. Companies themselves have fared differently as the pandemic has worn on, with the very largest firms benefiting the most from government relief. Of the companies handing out lay-off notices, many of those employees are in retail and hospitality, with the majority of jobs in those industries at the bottom end of the pay range. The Federal Reserve Bank of New York studied small business owners and estimated that 17% would have to close permanently if forced to go two months without revenue, and many are well past this now.

Some of the “relief” offered in the federal stimulus will exacerbate the inequities: new rules allowing you to take money from your 401(k) without penalty, to waive required minimum distributions, reducing taxes to Social Security and Medicare – these all deplete resources that will be needed to have any kind of financially secure future.

WHAT’S NEXT?

In mid-August, Congress went on vaca without a new relief package. The $3.4 trillion HEROES Act the House passed in May would have provided enhanced unemployment benefits through January, rental assistance, and would send a $1 trillion lifeline to state and local governments. That’s money to keep government workers employed and off the unemployment rolls, to continue to provide services like schools, transportation, repair of downed power lines, snow clearing and the like. The price tag was later reduced to $2 trillion, and the Republicans refused the deal. They proposed a package two months later, with liability protection for employers from coronavirus-related lawsuits and spending limited to $1 trillion.

Historian Heath Cox Richardson of Boston College offered a dark rationale for the slow progress on new relief: with the federal moratorium on evictions ended on July 31st, she notes that “evicted adults will be far less likely to vote” in November.

However, the US government will be out of money at the end of September, so to avoid another government shutdown (remember December 2018?), we’ll see who blinks before we get to the brink in a few weeks.

HOW ARE WE GOING TO PAY FOR IT?

This is a reasonable question, but it’s a red herring. The same people asking this question now were not worried about how we were going to pay for the tax cuts that came with the Tax Cuts and Jobs Act (TCJA) in 2017; those tax cuts added $1.3 to $1.9 billion to our national deficit over a ten-year period, while the economy was operating on all cylinders, pre-pandemic.

But the question remains. And here is the answer: from tax revenues, over time. We pay it back with an economy that is damaged as little as possible, from workers who can get back to work safely and as quickly as possible, and through growth – real growth – from innovation, technology, and embracing change. In addition, there is no better time than right now to borrow: Money is CHEAP.

Even as messed up as our federal leadership is at this time, as warped as the inequality of our system is now, and as hobbled as our economy is, I’m still going to bet on the U.S. for long-term growth. To get that growth, spending to spare the economy and everyone who is part of it even more long-term pain is a good option.

The alternative is to do nothing. Don’t spend the money. Wait it out. Hope for herd immunity. That is an option.

BEWARE A “RETURN TO NORMALCY”

There was a similar call after World War I. It was Presidential candidate Harding’s campaign slogan in fact. Understandably, the world was exhausted after four years of war followed by the 1918 pandemic, and all anyone wanted was for everything to go back to the way it was.

But a return to normalcy is another way of saying we want to go back to how things were before this year, and many would say things were not that great. The pandemic has only brought to light many flaws in our economic system and social safety net, and I’ll argue that we don’t want to go back, we want to move forward. We want to learn from this experience, to make progress in the months ahead.

We have already learned so much:

• Working from home can be an effective, efficient option for many

• Everyone needs sick leave to keep all of us healthy

• Health care needs to be universal to keep us productive, and in the long-run cheaper for everyone

• Telemedicine can work to extend and leverage traditional health care

• Child care remains primarily female-provided work, and an obstacle to equity at the office

• The planet is healthier than it has been in decades – after only a few months

YOUR BRAIN ON FEAR – OR LOVE

This discussion started with our mental health crisis, the struggle to function well when under stress. Our reptilian brain wants to fight or flee. We want this all to go away, or we want to kill something. But our limbic brain, the mammalian part of our grey matter that is responsible for our success as humans (so far), connects us socially and emotionally, and helps us work together to survive. The reptilian brain understands anger and fear, the limbic brain wants love and play. That’s why being isolated makes us so messed up: we do actually need each other. This isn’t an individual fight, it’s a collective one, a global one, and we literally have the brains to figure it out. Together.

The repeating theme is connection. What I do affects you, what you do affects me. Things you might think only benefit the recipient also benefit those around him or her: a healthier coworker is better for everyone, taking time off when you are sick keeps others from becoming ill, providing a foundation so that everyone who wants to work can do so to their maximum capability reaps benefits to all of us in addition to the individual. If we can focus on the outcomes we want, and work towards them, we could emerge stronger than ever. We could lead the way out of this.

WHAT YOU CAN DO

We are all connected, but you can only do what you can do. So what might that be?

• Fight quarantine fatigue – It’s easy to let up on our new protocols. We’ve learned a lot about the coronavirus since it arrived, including that you don’t want to get it. “Long-haulers” are dealing with its effects months after the initial diagnosis. Wash your hands, wear a mask, and keep six feet away from those not in your household.

• Revisit your cash reserve and see what you can do to shore it up. Shoot for at least six months of expenses.

• Review your portfolio. Stock markets have recovered since March’s dip, even with recent turbulence, and now is a good time to take profits and reallocate according to your target asset allocation. Yes, this may mean paying taxes. And speaking of taxes…

• Talk with your tax advisor about tax strategies for 2020. Taxes will eventually be higher than they are now, regardless of who wins the election in November. Now is a good time to look at opportunities for Roth conversions, accelerating charitable contributions, and the like.

• Think about accelerating grants from a donor-advised fund (DAF). You already banked the big tax benefit from your DAF when you made your contribution to it. Now may be the time when the organizations you care about most really need your help.

• Consider giving blood. Blood banks have been hit hard since their blood drives at large companies have been squashed – and we expect a Second Wave of Covid-19 coming in the Fall.

• Maintain your good health. If you’ve put off going to see your doctor or dentist, now would be a good time to check in, before we hit Winter and a potential second coronavirus wave. Add to that eating right, exercising (and thinking about an exercise plan for Winter if we’re not back at our gyms), and doing all the other things your mother nagged you about doing to take care of yourself. She was right.

• Get your flu shot.

• Give others a wide berth. To avoid Covid-19, and to give others who might be struggling under stress the benefit of the doubt.

• Find a source of comfort to help you cope: music, art, exercise, a good meal.

• At a minimum, start planning your New Year’s Eve party, because eventually, in a few months, we will get to 2021. It just might seem like it will take 100 years.

The next six months will be difficult, but we will get through it. We may find ourselves at a time when a crisis breaks wide open into opportunities to make our lives better. Until then, take a breath, wear a mask, and heed the advice from this week’s Wallingford Chevron sign: